Starting a family changes everything—your priorities, your finances, and especially how you plan for the future. While it’s easy to put off legal paperwork when life is busy, young families in Georgia need solid legal planning now more than ever.

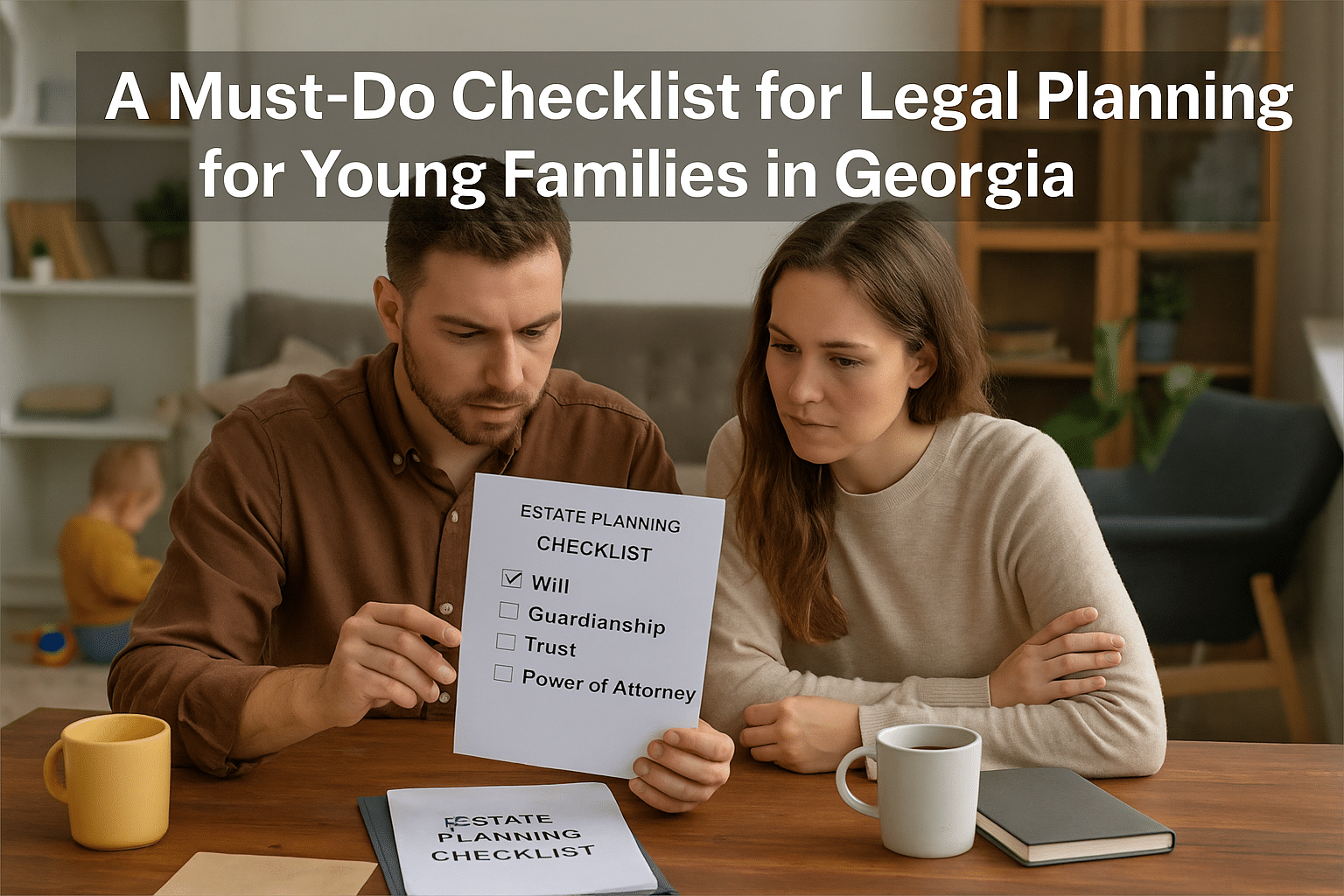

Here’s a practical, no-fluff checklist to make sure your family is legally protected in case something unexpected happens.

1. Create a Will

A will isn’t just for dividing assets. For young families, it’s your chance to:

- Name a guardian for your children

- Decide who manages your estate

- Make sure your assets go where you want

Without a will, Georgia courts will decide who raises your children and who inherits your property.

Learn how to write a will for an estate plan in Georgia

2. Appoint a Guardian

This is the most important decision for many young parents. Name someone you trust to care for your kids if both parents die or become incapacitated.

Make sure your guardian choice is:

- Willing and able

- Emotionally and financially stable

- Informed of your values and preferences

You should also name a backup guardian, just in case.

3. Set Up a Trust (If Needed)

A trust can:

- Manage your children’s inheritance until they reach adulthood

- Avoid probate delays

- Allow you to control when and how money is used for your children

This is especially useful if you have life insurance or real estate.

Explore: Can you have more than one trust in Georgia?

4. Designate Powers of Attorney

If you become incapacitated, someone needs legal authority to act on your behalf.

- A Durable Power of Attorney allows someone to manage finances

- A Medical Power of Attorney (included in Georgia’s Advance Directive) lets someone make healthcare decisions

Without these, your family may need court approval to manage your affairs.

5. Complete an Advance Directive

An Advance Directive for Health Care in Georgia lets you:

- State your wishes for medical treatment

- Appoint a healthcare agent

- Avoid confusion or family conflict in a crisis

Read: Why hospitals ask about advance directives

6. Review Life Insurance

Do you have enough coverage to protect your family if something happens to you?

Term life insurance is affordable and often enough for young families. You’ll also want to:

- Keep your policy updated

- Name the right beneficiary (often a trust, not minor children directly)

7. Name Beneficiaries on Key Accounts

Make sure your:

- Bank accounts

- Retirement accounts

- Life insurance policies

have current, accurate beneficiaries. These designations override your will—so don’t leave them blank or outdated.

8. Keep Digital Access Organized

Store passwords, account info, and legal documents in one secure place. Let your spouse or chosen executor know how to access it if needed.

9. Revisit Your Plan Regularly

Life changes fast. Revisit your plan if you:

- Have another child

- Move to a new home

- Start a business

- Get divorced or remarried

Estate plans aren’t one-and-done. They grow with your family.

Final Thoughts

Legal planning isn’t just for the wealthy or elderly—it’s for any Georgia family that wants peace of mind. By getting these essentials in place, you’re protecting your children, your assets, and your wishes.

At Hurban Law, LLC, we help young families across Georgia put smart, affordable plans in place without unnecessary complexity. If you’re ready to take the next step, contact us today.