Estate Planning is an important aspect of financial management that ensures your assets are distributed according to your wishes after you pass away or become incapacitated. One term that often shows in this process is “Per Stirpes.” But what does it mean, and should you check the per stirpes box?

What Does “Per Stirpes” Mean?

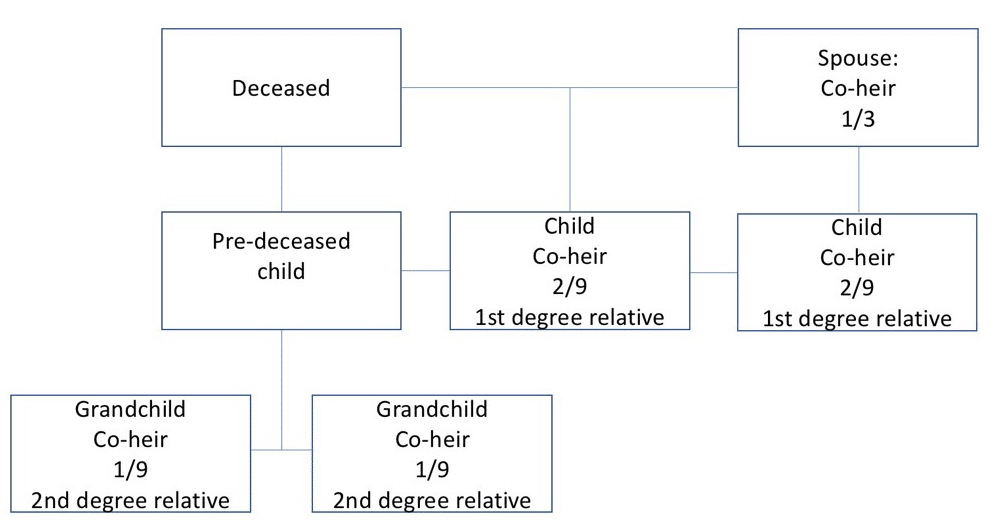

“Per Stirpes” is a Latin term that translates to “By The Roots” in English. In estate planning, it refers to a method of distributing assets among descendants. When you check the per stirpes box, it means that if a primary beneficiary predeceases you, their share of the inheritance will pass to their descendants, typically divided equally among them.

The Importance of Understanding Your Options:

When completing your estate planning documents, you may encounter the per stirpes option. It’s essential to understand the implications of checking or not checking this box, as it directly affects how your assets will be distributed among your heirs. Let’s explore some scenarios to illustrate the significance of this choice.

Scenario 1: Without Checking the Per Stirpes Box

If you choose not to check the per stirpes box, and one of your primary beneficiaries predeceases you, their share will be redistributed among the remaining living beneficiaries, excluding the descendants of the deceased beneficiary. This method is known as “per capita” distribution.

Scenario 2: Checking the Per Stirpes Box

Conversely, if you decide to check the per stirpes box, the deceased beneficiary’s share will be divided among their descendants, ensuring that your assets flow through the family lines. This approach may be particularly beneficial if you want to include grandchildren or great-grandchildren in the inheritance process.

Factors to Consider:

- Family Structure: The decision to check the per stirpes box may depend on the structure of your family. If you have multiple generations and wish to include all descendants, per stirpes might be the appropriate choice.

- Fairness: Consider what you believe is fair in terms of asset distribution. If you want to ensure that each branch of your family receives a share, per stirpes may align with your intentions.

- Legal Advice: Before making any decisions in your estate planning, it’s advisable to consult with legal professionals. They can provide personalized advice based on your unique circumstances and applicable laws.

Get Help Today & Consult With An Estate Planning Attorney

The decision to check the per stirpes box in your estate planning documents is a crucial one that requires thoughtful consideration. Understanding the implications and potential scenarios can help you make an informed choice aligned with your wishes for the distribution of your assets. If in doubt, seek guidance from legal professionals to ensure that your estate plan accurately reflects your intentions and provides for your loved ones in the way you desire. We will offer you the support and guidance you need at Hurban Law.

The Information On This Website Is For General Information Purposes Only. Nothing On This Or Associated Pages, Documents, Comments, Answers, Emails, Or Other Communications Should Be Taken As Legal Advice For Any Individual Case Or Situation. This Information On This Website Is Not Intended To Create, And Receipt Or Viewing Of This Information Does Not Constitute, An Attorney-Client Relationship.